Managed accounts

Vistafolio provides a unique facility where we analyse, select and manage global stocks and shares in your own account. We offer an institutional-grade separately managed account service accessing wholesale rates. You will set up your own global brokerage account (under a separate agreement with the broker) with us having execution-access only to run our strategy.

This is not a retail service and is subject to eligibility criteria.

How does it work?

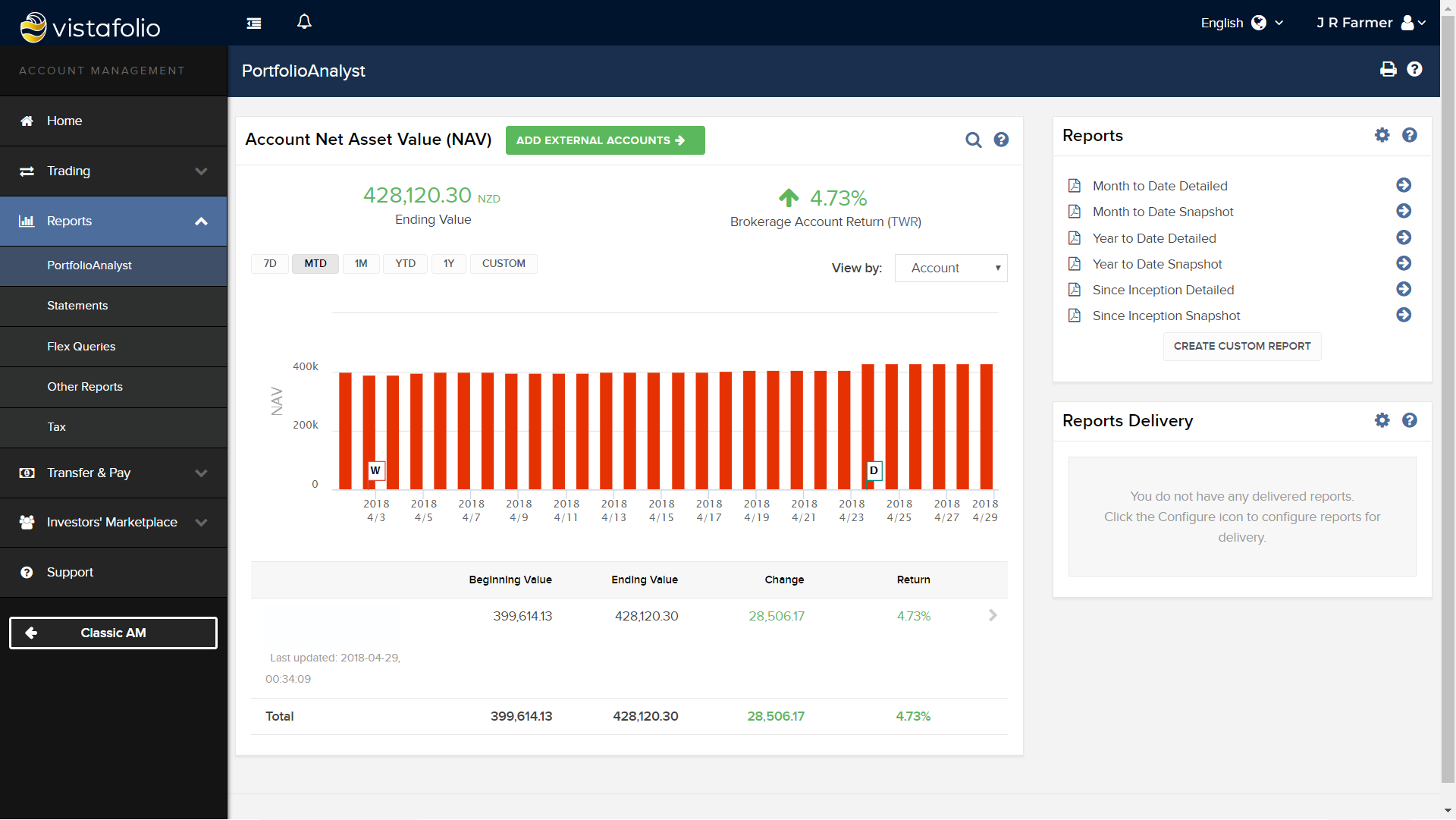

See below for sample client, Jeff Farmer:

J R Farmer

Protected account in your name (or trust/company) with online access

Deposit/withdraw funds

J R Farmer

Bank Account

Banks/currencies supported from most countries with same day transfers

Manage portfolio in accordance with strategy

Vistafolio

Investment Mandate

You sign this with us to enable us to build and manage your portfolio

Why choose an individually managed account?

Integrity and control: The account remains in your name and ownership - denominated in your preferred currency. There's no blind pooling in a fund, so you have more control over your investments. Perhaps this is why institutional investors the world over prefer separately managed accounts.

Better returns: Low overhead, regulatory and operating expenses mean that investor fees are focused on in-depth research, analysis and effective management of your investments. There are no additional fund, administrative or custody charges (excepting low brokerage on individual trades).

Protection: On the account side, your brokerage account is protected by broker compensation arrangements. The broker's size and scale affords robust account protection.

Timeliness: We invest your money in the opportunities that are relevant at the time you invest, match your investment plans, available funds and currencies held. We run a limited number of accounts at any one time to optimise our service.

Transparency: Online access to your investment account providing full visibility on what is happening with your investments. You'll also have access to a range of portfolio analysis and reporting options, plus our monthly update on the performance of the strategy. And we 'eat our own cooking' - the life savings of our partners are invested in the same strategy.

Flexibility: You can deposit funds anytime or withdraw funds from your account by pre-advising. Most major currencies and bank accounts worldwide are accepted. Note: Your brokerage account is separate from our service, with us having execution-access only to conduct trades under the mandate agreement.

Investor experience: Receive immediate advice on trades and the reasons behind them as we invest in your account. Login to your portfolio at any time and watch what's happening in the markets. Be a part of our exciting and rewarding investment strategy.